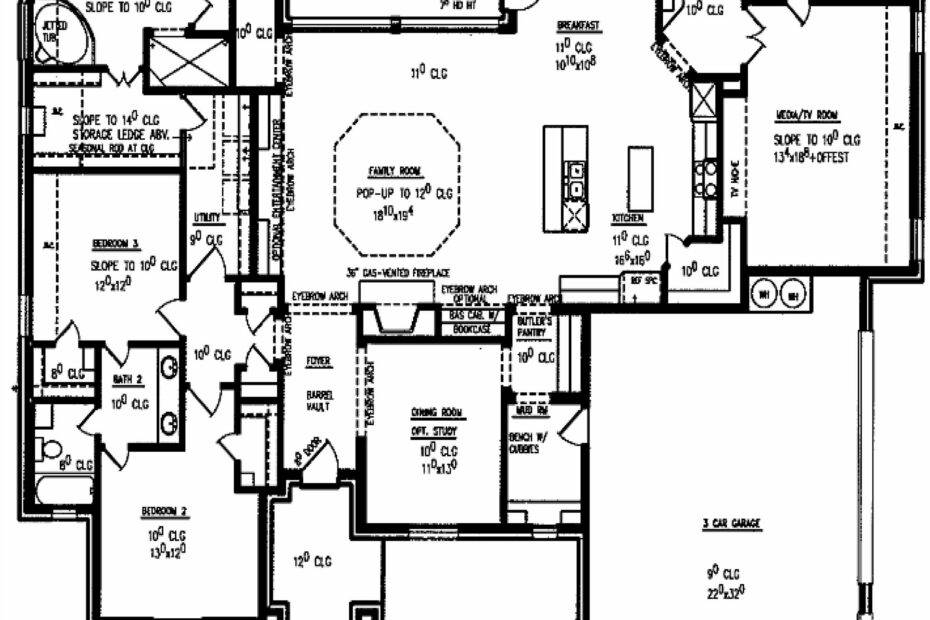

House Designs In Limpopo Limpopo Villages Tuscan Storey Pbs

Hello there, Introducing You to The Top House Designs in Limpopo: Limpopo is a beautiful province in South Africa that is known for its natural beauty, vast landscapes, and thriving communities. It’s no wonder that… Read More »House Designs In Limpopo Limpopo Villages Tuscan Storey Pbs